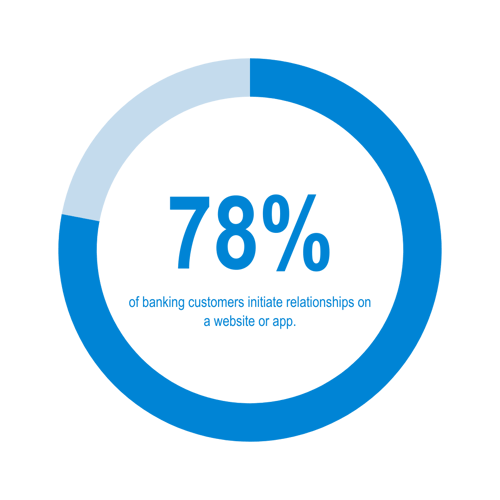

As digital-first customers demand more from their financial institutions, banks recognize that being all things to all users is impossible. In fact, 78% of banking customers initiate relationships on a website or app, driving the need for more banking automation. From personalized financial recommendations to instant customer support, evolving expectations are forcing banks and lenders to pivot their focus to high-quality customer experiences.

The result? A significant shift in the industry from the traditional bank-centric approach to a multichannel customer-centric approach. This is where businesses focus on delivering a seamless customer experience across multiple channels. Consequently, it has become more urgent than ever that banks identify which digital solutions will allow them to best meet and serve customer needs while also mitigating risk.

Let's take a look at the challenges that need to be addressed and how digital automation can help banks stay competitive in today's digital landscape.

ADDITIONAL CHALLENGES BANKS MUST ADDRESS

There are several challenges banks need to consider while vetting solutions to improve their customer experience:

- Tighter Regulation: Intensified supervision and regulatory tailoring are impacting bank profitability. With enhanced bank risk management practices and governance, there is an increased acquisition cost of people and processes.

- Strategic M&A: Regional banks are exploring strategic options from possible sales and help from private market solutions. U.S. banks are trying to predict White House regulations, causing even greater stock price pressure.

- Money is Moving Out of the Banking System: Growing anxiety from headlines about banks collapsing is causing more assets to flow into U.S. money market mutual funds for safekeeping and superior yields.

While these challenges may not seem like they have a direct impact, they indirectly hinder the delivery of exceptional customer service by diverting resources, introducing uncertainty, and potentially limiting funds for banking operations. Banks must navigate these challenges effectively to maintain a high level of customer satisfaction and loyalty.

WHY DIGITAL AUTOMATION MATTERS

It is essential for financial institutions to address the gaps in customer satisfaction. In a recent study, only 32% of wealth and asset customers claimed they were extremely satisfied with their firm's ability to resolve customer inquiries swiftly. In today's evolving digital age, customers expect intuitive, custom digital experiences that emphasize their overall financial well-being. To meet these needs, digital solutions and automation are non-negotiable for financial institutions.

Innovative banks that offer digital-first banking built with automation see a noticeable improvement in speed and data accuracy. This allows them to deliver a truly proactive and exceptional experience.

IMPLEMENTING DIGITAL AUTOMATION

With Salesforce, banks can easily leverage solutions like data-driven insights, personalized digital experiences, and workflow efficiency leading to overall enhanced customer experience. Specifically, Financial Services Cloud enables banks to deliver automated, intelligent, and real-time banking experiences that wow customers and members.

Additionally, there is a significant opportunity for banks to use digital automation to collect more consistent and accurate customer data. This investment can only offer a personalized customer experience, but also dramatically improve CSAT. Banks and lenders are partnering with Ascend to build digital solutions for better customer experiences. These solutions will manage customer data and automate processes helping them stay competitive.

There are several opportunities shaping how banks will need to adapt to remain competitive.

- Rise of Digital Banking Channels to Manage Finances: Institutions must provide seamless online and mobile banking experiences, enabling customers to conduct transactions, access account information, and perform financial management tasks conveniently.

- Artificial Intelligence (AI) and Machine Learning (ML): The integration of AI and ML technologies presents opportunities for banks to automate processes, enhance customer service, and make data-driven decisions.

- New Regulatory Framework for Open Banking: The emergence of open banking regulations provides opportunities for banks to collaborate with third-party providers and create innovative financial solutions.

- Increased Importance of Cybersecurity: Banks must invest in advanced cybersecurity technologies and practices to protect customer data, prevent fraud, and maintain trust.

- Demand for personalized banking experiences: Banks can leverage data analytics and customer insights to offer tailored product recommendations, personalized financial advice, and customized marketing communications.

TEAM UP WITH ASCEND

Banks and lenders are partnering with Ascend to build digital solutions for better customer experiences. These solutions will manage customer data and automate processes helping them stay competitive. As a Summit Salesforce Partner since 2009, we have completed 800+ successful projects and achieved a 4.9-star customer satisfaction rating.

Ascend Technologies is a Salesforce consulting partner enabling business growth and innovation. We are trusted business advisors focused on Salesforce, Cybersecurity, Cloud and Infrastructure, and Private Equity solutions. Ascend ensures a seamless IT journey, encompassing all clouds and top ecosystem partners.

Connect with us on LinkedIn, YouTube, Twitter, and Facebook. Looking for insight or assistance regarding your technology efforts? Schedule a consultation below!

Written by Brian Mamassian, Salesforce Expert

.png?width=500&height=500&name=Yellow%20Teal%20Facebook%20And%20Instagram%20Chart%20Actions%20and%20Results%20Instagram%20Post%20(1).png)